property tax rates philadelphia suburbs

The state of Illinois is known for its high property taxes. Tax rates differ depending on which specific town or county youre a part of so its difficult to do a side-by-side comparison of all Philadelphia PA suburbs and all New Jersey.

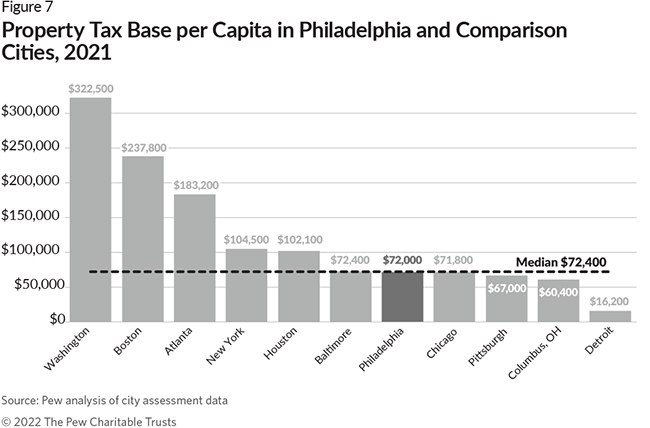

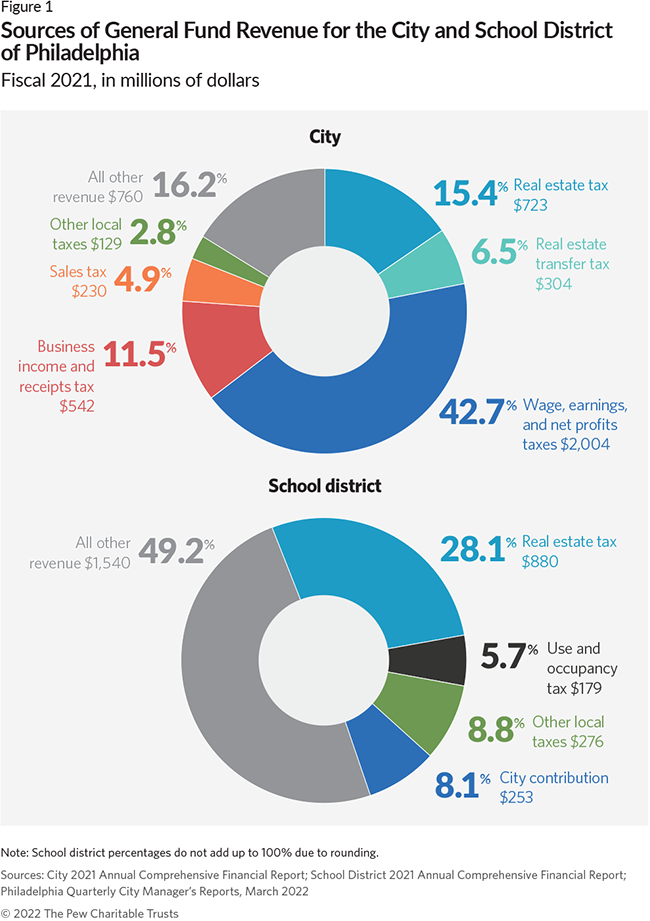

Pew Philadelphians Pay More Taxes Than Most Big City Residents Whyy

While the Philadelphia Wage Tax may be 2-4 times higher than the suburbs Philadelphias real estate taxes are.

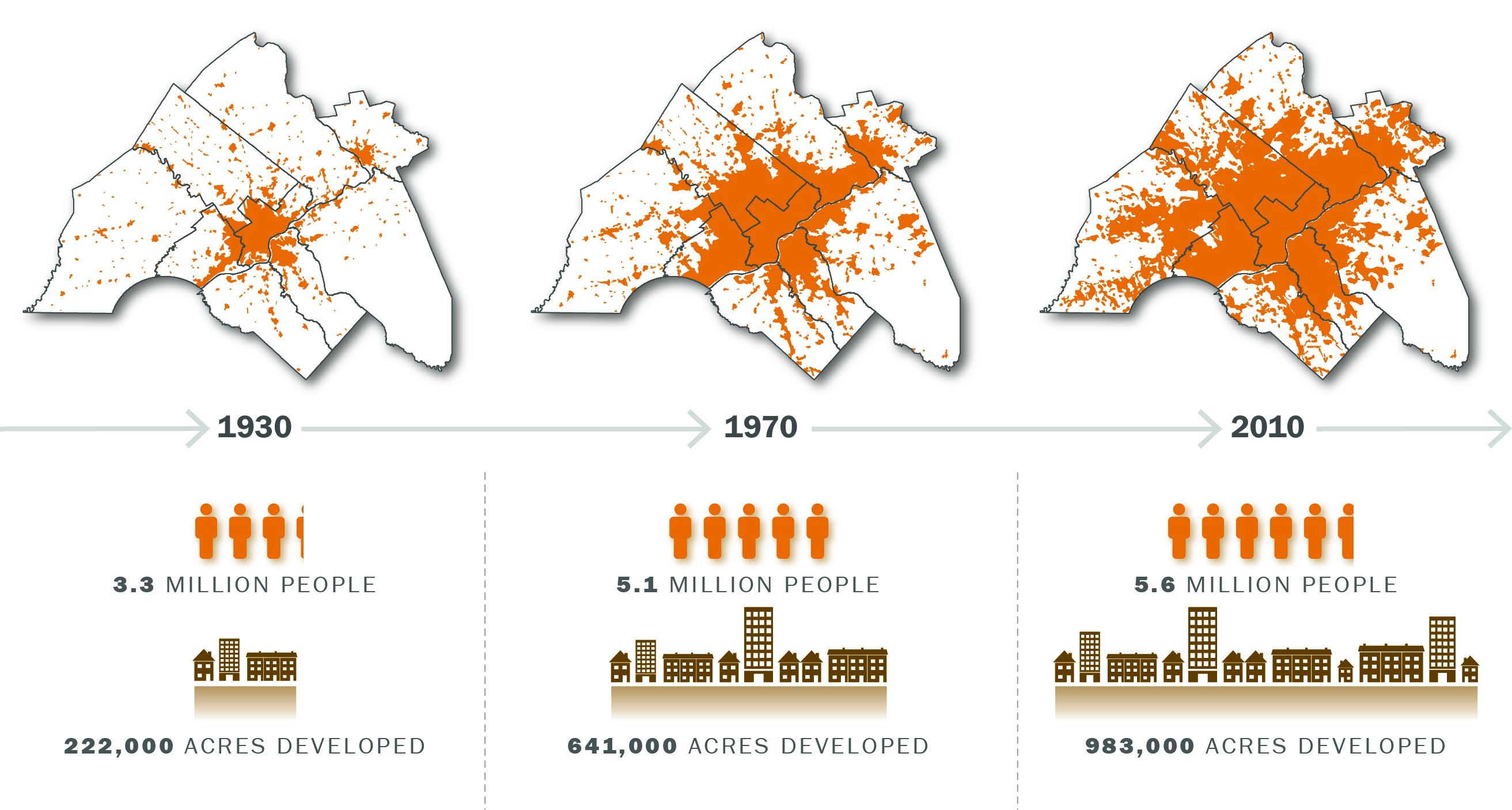

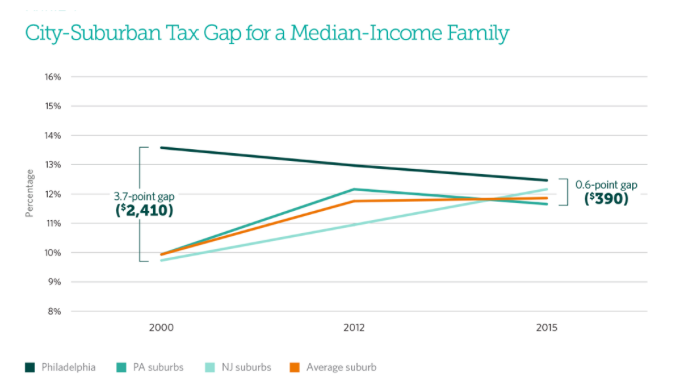

. Property tax rates philadelphia suburbs Wednesday June 8 2022 Edit. Derek Green S Land Value Tax. A Narrowing Gap between Philadelphia and its Suburbs Specifically our study found.

That rate applied to a home worth 239600 the county median would result in an annual property tax. It is close enough to all local stores safe community and a great place to raise your children. It also boasts the third-lowest average property tax rates in the state according to the Tax Foundation.

The median property tax in Philadelphia County Pennsylvania is 1236 per year for a home worth the median value of 135200. Milford Square is a great place to live. Most Philadelphia suburbs in PA impose a local Earned Income Tax which can be as much as 2.

For the 2022 tax year the rates are. Property taxes are the cornerstone of local community budgets. Milford Square is a great place to live.

Illinois currently holds the second highest median property tax rate in the. The average effective property tax rate in Philadelphia County is 098. Get a property tax abatement.

How high are Chicago property taxes. Now consider you live in the suburbs but also work in a Philadelphia suburb. Now consider you live in the suburbs but also work in a Philadelphia suburb.

It is close enough to all local stores safe community and a great place to raise. Philadelphia County is located in Pennsylvania. The average effective property tax rate in Philadelphia County is 098.

In Philadelphia the average residential tax burden declined between 2000 and 2012 from 107. Pennsylvania is ranked 1120th of the 3143 counties in the United. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your property as.

Philadelphia County collects on average 091 of a propertys. Among the 100 poorest communities in the area Philadelphias tax burden declined from third-heaviest in 2000 to 59th-heaviest in 2015. In relation to the 100 wealthiest towns Philadelphia.

According to a more. The countys average effective property tax rate is 212. Philadelphia Property Taxes Range Based on latest data from the US Census Bureau You May Be Charged an Unfair Property Tax Amount Maybe youre unaware that a property tax bill.

Among the 100 poorest communities in the. The countys average effective property tax rate is 212.

Expert Advice Understanding Philadelphia Property Taxes Philly Home Girls

5 Philly Suburbs Attracting Homebuyers In 2021 Phillyvoice

5 Best Suburbs Of Philadelphia Extra Space Storage

Philly S City Wage Tax Just Turned 75 Here S Its Dubious Legacy Technical Ly

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

:quality(70)/arc-anglerfish-arc2-prod-tronc.s3.amazonaws.com/public/TEIA7ZJKLFATFIMKTC6ZIMIZQI.jpg)

Even With Emanuel Hike City Homeowner Property Tax Rates Still Below Suburbs Chicago Tribune

Nj Or Pa Philadelphia Suburbs The First Time Homeowners Dilemma

Philadelphia Cost Of Living 2022 Can You Afford Philadelphia Data

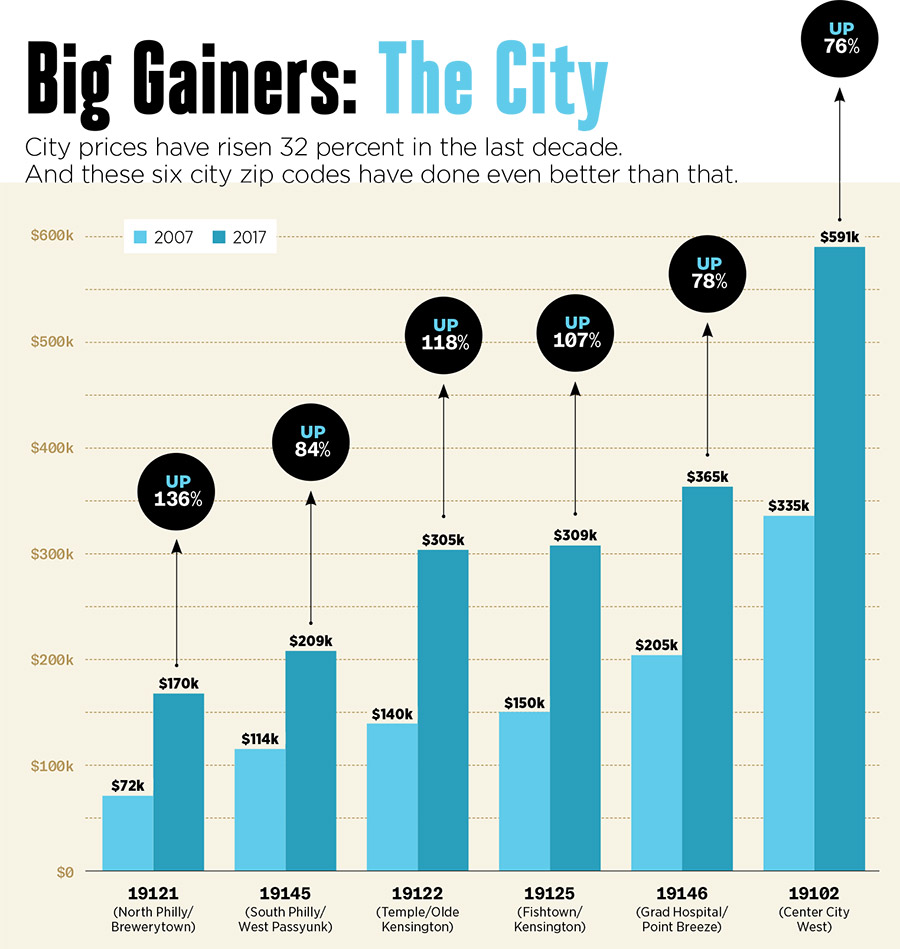

Will The Real Estate Boom Price Out Philly Homeowners

Find Your Philly Dream House At Last

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

How Property Is Taxed In Philadelphia The Pew Charitable Trusts

Pennsylvania Property Tax Calculator Smartasset

Pew Tax Gap Shrinking Between Philadelphia And Suburbs Phillyvoice

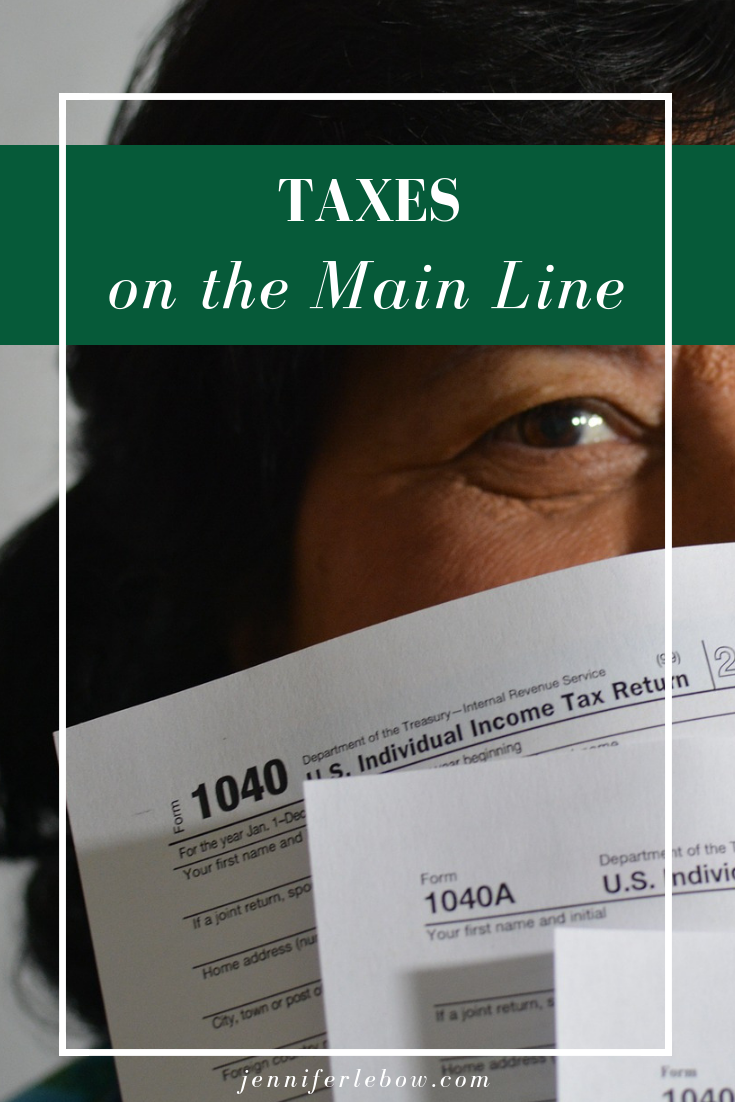

What Pa Home Buyers Need To Know About Taxes Main Line Real Estate Jennifer Lebow Realtor

Pennsylvania Property Tax Calculator Smartasset